Biden’s Tech Regulators Put “Faculty Lounge Populism” Ahead of Consumer Protection

An elitist approach rooted in academic theories, not reality

The Biden Administration worked to execute an “economic populism” agenda meant to win back working-class voters. In practice, however, their actions towards industry, and tech specifically, amounted to faculty lounge populism – policies generated from Ivy League theorists focused on the interplay of corporate power and politics, but that did little to directly address the everyday needs and concerns of consumers.

Biden’s regulatory policymakers in particular pushed an anti-corporate brand of populism, casting Big Tech as the villain. Populism typically relies on an “us vs. them” narrative – pitting “the people” against a corrupt elite – and these officials embraced a “Big Tech vs. the people” storyline.

Yet as Adam Jentleson observed, Democrats looking to blame billionaires while relying on the critiques from elite scholars generates candidates that:

“are the inverse of what voters want—people with the cultural sensibilities of Yale Law School graduates who cosplay as populists by over-relying on niche issues like Federal Trade Commission antitrust actions.”

In the next few posts, we’ll explore how this ivory-tower approach to tech policy ignored consumer priorities and ultimately failed to deliver for voters.

Ignoring Privacy and Security for Big Tech Grudges

Consumers have consistently signaled they want digital privacy, data security, and protection from scams. Biden’s tech enforcers instead launched ideological crusades against technology companies.

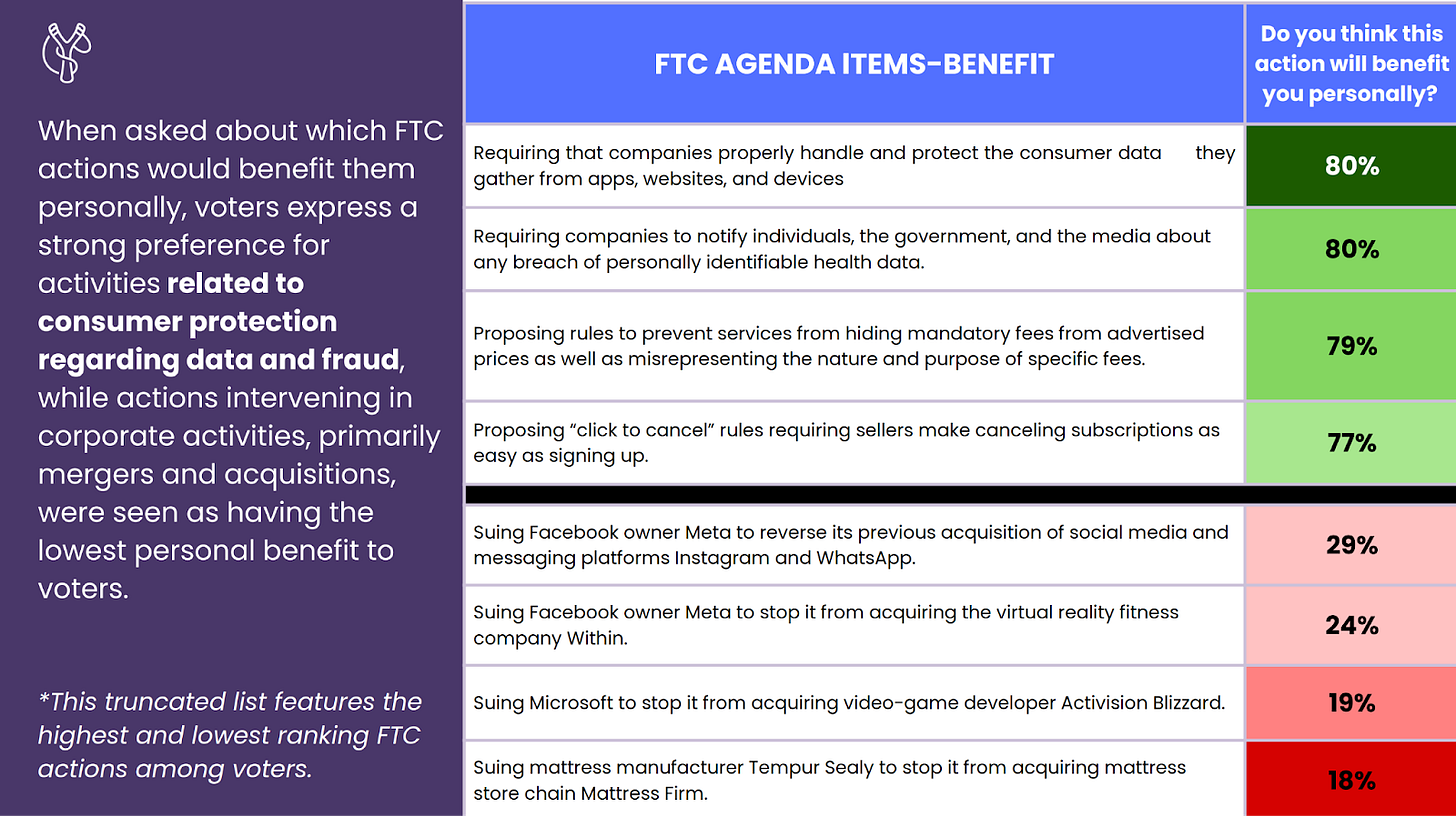

An August 2024 Slingshot Strategies poll of voters’ thoughts on FTC actions was striking: when voters were asked which actions of Lina Khan’s FTC benefited them the most and least, the top-ranked were common-sense protections (data security, breach notifications, junk fee bans, easy cancellations), while the lowest-ranked were Khan’s headline-grabbing tech merger lawsuits.

Voters clearly valued traditional consumer protections far more than these anti-merger battles.

Biden’s regulators fixated on making examples of Silicon Valley giants even when those cases offered little tangible payoff for consumers. White House adviser Tim Wu argued that enforcers should punish Facebook’s past mergers even long after they were approved.

The FTC and DOJ followed this playbook, pouring resources into headline-grabbing litigation to punish the largest and most successful tech companies as their valuations and revenue increased, but ordinary people weren’t asking for that. They were worried about their privacy and data, not whether Facebook owns a fitness app or Microsoft owns a game studio.

By prioritizing academic crusades over bread-and-butter protections, Biden’s tech regulators left consumers’ real concerns on the back burner.

Cost of Living vs. “Post-Price” Antitrust

Nothing better illustrates the faculty-lounge mindset than its attitude toward prices. At the height of inflation during his administration, Biden’s tech advisers argued that low prices shouldn’t be the focus of antitrust.

Lina Khan’s landmark law review article, “Amazon’s Antitrust Paradox,” criticized the “narrow focus on consumer welfare as largely measured by prices” in antitrust enforcement. She urged regulators to pursue monopoly cases even when companies were cutting prices – prioritizing abstract theories of market power over consumers’ immediate savings. Khan writes:

“[The article] argues that the current framework in antitrust—specifically its pegging competition to “consumer welfare,” defined as short-term price effects—is unequipped to capture the architecture of market power in the modern economy. We cannot cognize the potential harms to competition posed by Amazon’s dominance if we measure competition primarily through price and output.”

That theory collided with reality when the cost of living soared. As the columnist Matt Yglesias noted, the administration rarely prioritized keeping goods affordable over narrow political interests, an approach that looked especially foolish amid the worst inflation in decades. Voters facing higher prices saw an administration preoccupied with esoteric fights against tech companies instead of single-mindedly trying to lower everyday costs.

It’s no surprise that this “populist” message failed to resonate. Noah Smith wrote:

“Warrenite anti-corporate approach was populism without popularity — an elite intellectual project that was mostly wrong on the actual economics while also failing to spark enthusiasm among voters.”

From “Know Before You Owe” to Tech Obsessions

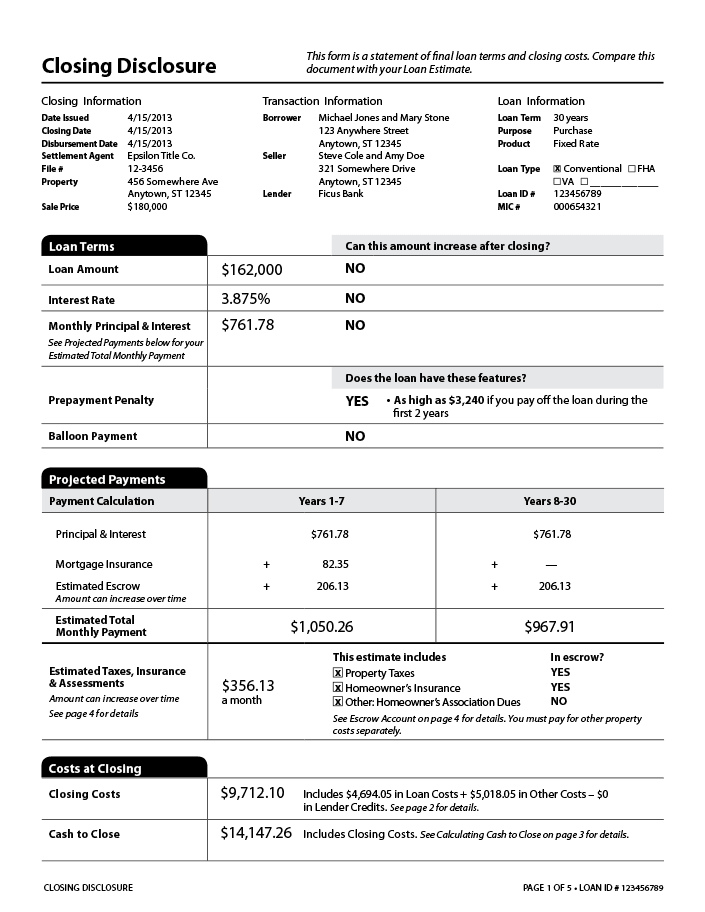

The contrast between two eras of Democratic consumer protection is telling. Under President Obama, the Consumer Financial Protection Bureau (CFPB) scored a practical win with its “Know Before You Owe” initiative, simplifying mortgage forms so homebuyers could actually understand the fine print.

The CFPB produced a single, easy-to-read disclosure (with input from consumers) that demystified the mortgage process. It delivered real value to millions of Americans making one of their biggest financial decisions.

Under President Biden, by contrast, CFPB Director Rohit Chopra largely abandoned those efforts in favor of high-profile skirmishes with tech firms.

Instead of focusing on practical wins to protect consumers, Chopra pressured Apple to open the iPhone’s tap-to-pay chip (arguing Apple’s ban on third-party payment apps harms consumers) and warned people not to keep money in nonbank apps like PayPal or Venmo, urging stricter oversight of those services.

Few Americans wanted a war on Apple Pay or Venmo; they cared more about credit card fraud, predatory loans, and hidden bank fees. The CFPB went from being a selling point for Democrats to an organization that handed ammunition to the administration’s critics by picking fights voters disagreed with or didn’t care about at all.

The incoming Trump administration seized on this overreach, declaring an intent to “totally eliminate” the CFPB. An agenda that delivered few tangible wins during the Biden Administration ended up as an easy target: An example of liberal hubris that didn’t do anything to help the average consumer. As Yglesias noted:

“Biden’s…second term C.F.P.B. paid much less attention to coalition building…[seeking] to expand its authority to encompass regulating most of America’s major technology companies. …An agency that narrowly targets large banks can have some business community allies, while an agency that goes out hunting for new enemies can end up in trouble.”

Populism as Pretension

Biden’s tech regulation was supposed to be populist, but it was hatched in academia with little input or buy-in from voters to address their immediate concerns. Blaming “tech monopolies” or “the billionaire class” for everything makes for rousing rhetoric, but it doesn’t make the internet safer, online purchase secure, or prices lower.

These remain the top concerns of voters, and policies that drifted into other realms to address a post-neoliberal economic theory helped to lose their votes. The gap between what fires up anti-corporate activists and what matters to voters have proven politically costly for the party.

Hi Dave, I'm wondering how you measure the proposition that the FTC "[i]gnored privacy and security." From my perspective, the Khan FTC -- especially in 2023-4 -- was an golden era around privacy enforcement, especially with regard to a groundbreaking series of cases on location, health, and browsing data. I'm worried that your proposition about "ignoring" these topics is based more on an intuition derived from what the national press cared about, and doesn't actually grapple with the Commission's actual accomplishments in this area. I'd be interested in what you think of this. Thanks!

After Microsoft acquired Activision-Blizzard, there were - and continue to be - a large raft of layoffs across Xbox, canceled games and closed game studios. Xbox raised prices on their consoles and on their services like Xbox Game Pass. The latest Call Of Duty game under Microsoft-owned Activision was very poorly received.

Things have gotten worse after that acquisition. I wish it had been stopped. Lina Khan and the FTC were right to push back against it.